A Unified DeFi Ecosystem: Paradex Exchange Paradex Chain, XUSD (Native Synthetic Dollar), powered by $DIME.

© Paradex 2026. All rights reserved.

Zero Fee Perps (ZFP) are now live on Mainnet. Starting today, every retail trader on Paradex pays $0 in trading fees (maker or taker) on 100+ perpetual futures across web and mobile.

$0 fees for retail on every perp, win or lose.

- Always-on - not a promo, not capped, not limited to a few markets.

- The only frictions left are spread and funding (as it should be).

TL;DR: Keep your edge. Stop paying tolls.

The current affiliate-driven distribution model is broken. Many CEXs charge 5–10 bps, then hand 60–90% of that to KOLs to buy distribution. Users get overcharged so platforms can overpay middlemen; KOL relationships stay purely transactional and churn to the next highest rev share. It’s a race to zero with the retail trader footing the bill.Paradex is built for direct access: no custody middlemen and no distribution tax. Creators still matter, so we’re rolling out a new affiliate model that makes KOLs long-term owners not just rev-share renters via an explicit token allocation. Better economics. Better trust. Better outcomes.

Paradex earns from RPI (Retail Price Improvement) maker flow, not from retail takers. Professional market makers post RPI-flagged orders that are visible in the UI (for retail) and hidden from the API. These quotes only match against retail taker orders, reducing adverse selection. In return, makers price tighter with more size and pay 0.5 bps (0.005%) on RPI fills to Paradex. This micro-fee, at scale, funds Zero Fee Perps sustainably. Separately, high-frequency API takers pay 2 bps (0.02%). Over time, we’ll transition to toxicity-based fees.

It’s analogous to TradFi PFOF (e.g., Robinhood) with one key difference: orders are not selectively routed to a few market makers. All makers compete on an even playing field for retail flow; best price/size wins. Retail keeps $0 fees and gets price improvement; makers get curated flow; and Paradex earns a durable revenue line.

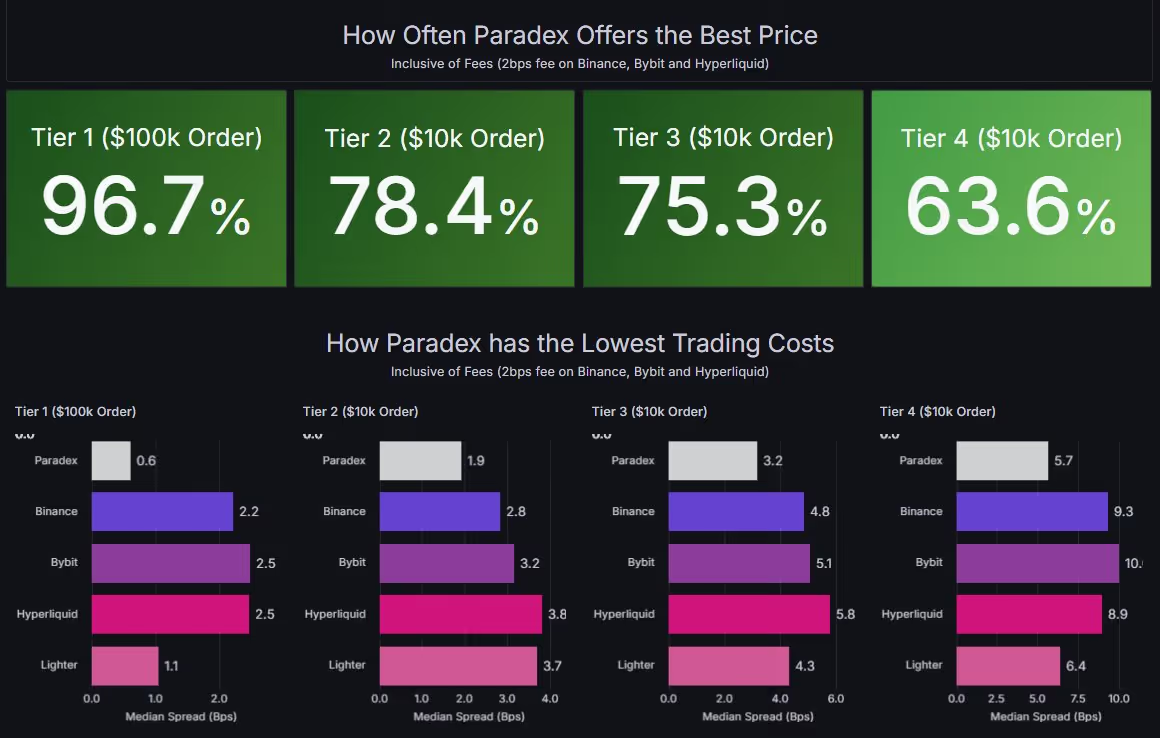

No. RPI reduces toxicity, which lets makers quote tighter spreads with more size. In fact, after adjusting for fees paid Paradex beats the top exchanges ~96% of the time on majors at $100k orders. Check out the Paradex Liquidity Monitor for real-time spreads and execution quality.

Fees were a tax on coordination. We’re removing them.

Trade perps but pay ZERO. Keep your fees as edge—and help us build a model where users, affiliates, and the venue win together.